The problem with modern personal finance is that it expects the average user to have a CFP, even though the average American only has a GED. It’s no wonder so many people struggle with money.

The Problem

Studies show that 43% of Americans are financially illiterate 1 , which means they lack the understanding to prudently make basic financial decisions. Financial illiteracy is diagnosed using a simple survey assessing basic financial knowledge, where answering 3 out of 5 questions correctly is a passing grade.

The survey questions are very basic. See for yourself:

- Diversification: Suppose you have some money, is it safer to put your money into one business or investment, or to put your money into multiple businesses or investments? (answer: multiple)

- Inflation: Suppose over the next 10 years the prices of things you buy double. If your income also doubles, will you be able to buy less than you can buy today, the same as you can buy today, or more than you can buy today? (answer: same)

- Numeracy: Suppose you need to borrow $100. Which is the lower amount to pay back: $105 or $100 plus 3%? (answer: $100 plus 3%)

- Compound interest 1 : Suppose you put money in the bank for two years and the bank agrees to add 15% per year to your account. Will the bank add more money to your account the second year than it did the first year, or will it add the same amount of money both years? (answer: more the second year)

- Compound interest 2 : Suppose you had $100 in a savings account and the bank adds 10 percent per year to the account. How much money would you have in the account after five years if you did not remove any money from the account? More than $150, exactly $150, or less than $150? (answer: more than $150)

Even though the average American has a tenuous grasp on these basic financial concepts, modern personal finance requires individuals to understand much more advanced concepts like interest rates, taxes, stocks, bonds, valuation, inflation, etc. It’s no wonder that 63% of Americans live paycheck to paycheck 2 and 77% of Americans report that they are anxious about their financial situation 3 .

Historically, wealthier Americans have navigated these challenges by hiring a personal financial advisor from firms like Merrill Lynch to help them make financial decisions, paying these advisors 100 bps of their net assets annually for their services. For less wealthy Americans, providing such personalized service is uneconomical and thus they had to fend for themselves. Hence the popularity of gurus like Dave Ramsey, Suze Orman, or Ramit Sethi who offer useful but impersonal advice targeted towards everyday Americans.

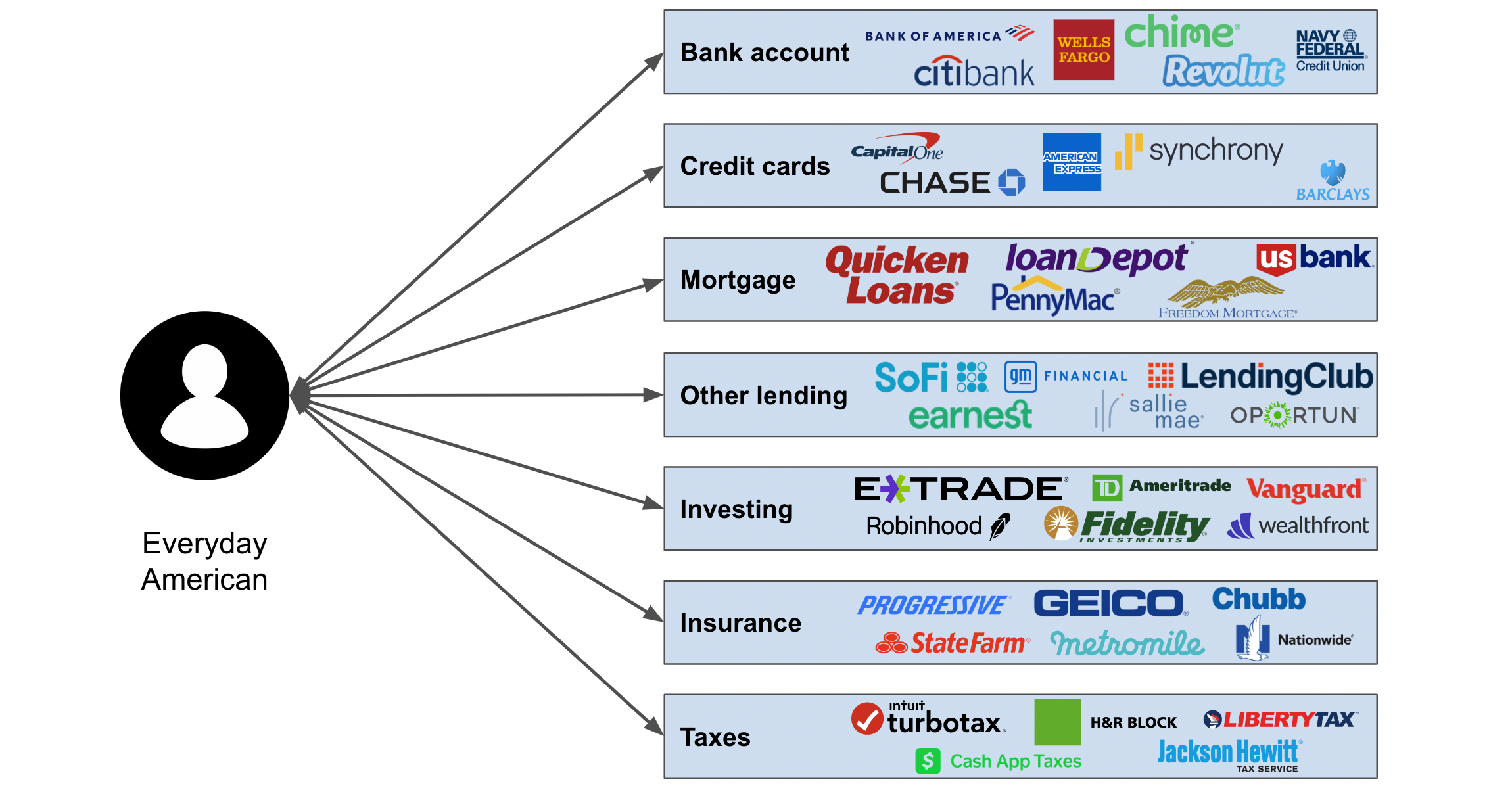

The nature of how financial services work for most Americans can be visualized as follows, where the individual has to manage multiple different vendors across a range of areas:

The Opportunity

With the advent of large language models (e.g. GPT-3) and other technologies like Plaid, is there an opportunity to:

- Understand an individual’s financial situation in the same way the best personal financial advisors would for their clients

- Provide personalized coaching to everyday Americans that can patiently educate them about financial concepts and guide them towards making good decisions

- Become a trusted advisor in helping individuals navigate their financial lives, helping them with things like budgeting, planning for retirement, making major purchases, choosing service providers, etc.

- Disintermediate the financial services industry by managing user’s financial life agnostic of the underlying provider

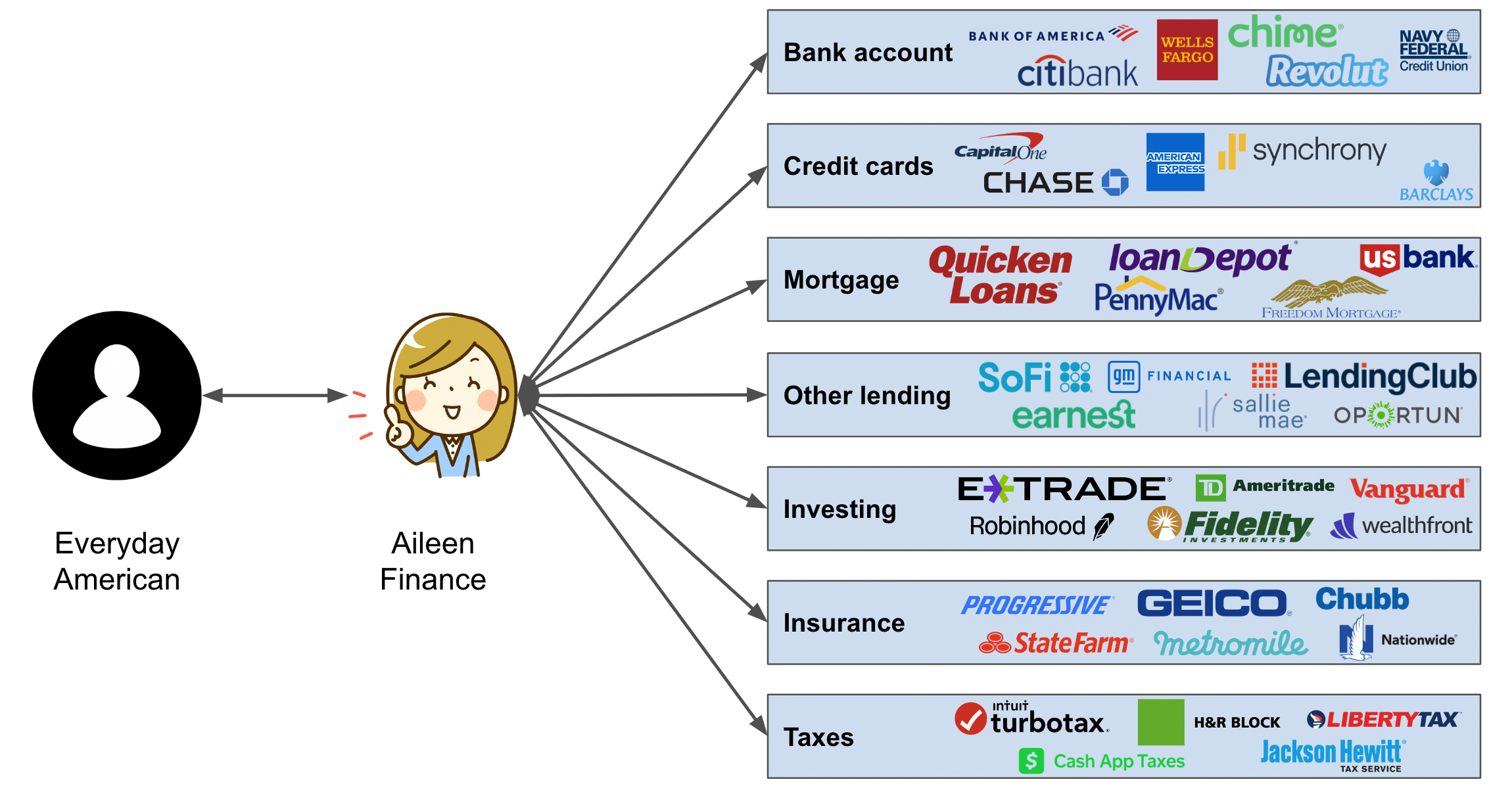

If successful, the opportunity is to transform the nature of the user’s financial life such that Aileen Finance is the intermediary between the user and all of the various financial services providers that they use, as illustrated here:

Business Model

Facebook and Google built enormously successful and defensible businesses by controlling user eyeballs, and monetizing their role as a gatekeeper to the rest of the internet. For Aileen Finance, by becoming the user’s trusted financial advisor we will have control of the user’s wallet, which is even more valuable than eyeballs. Such a position puts us in the position of gatekeeper to the rest of the $2 trillion financial services industry 4 .

Our early business model will be from earning referral bonuses from banks. For instance, banks like Chase, Chime, Ally, etc. currently spend $400+ in marketing to acquire just one bank account customer. At the same time, the majority of Americans are using a bank account that poorly fits their financial situation, which is why the average American pays more than $250 a year in overdraft fees 5 . We will advise our customers to use bank accounts that best fit their financial situation, and split the sign up bonuses with the user in a win/win manner. For lower income users, that will mean directing them to options like Chime or Current. For higher income users, it will likely mean directing them to options like Charles Schwab or Ally.

Longer term, our business model will shift to negotiating directly with service providers on behalf of our users and building seamless experiences for them to manage their financial lives. For instance, for our users who have entrusted us to manage their retirement investments, we would use our bargaining power to negotiate the lowest expense ratio for the funds that our users are invested in. Similarly for our users who are looking to apply for a mortgage, we would surface for them the best rates from providers who we have vetted to meet a certain bar of service. As we achieve critical mass in terms of the number of users, the role we play as intermediary would give us substantial leverage in monetizing access to our user base from financial service providers.

Key AI Focus Areas

- AI integrity and fairness - a key challenge with using LLMs is ensuring the integrity of the outputs, with Meta’s Galactica the latest illustration of the pitfalls. This is particularly sensitive in the field of personal finance, as users may be relying on these outputs to make major decisions with significant personal consequences. We are working to ensure our systems provide fair, accurate, and relevant insights to our users.

- Multi-domain dialogue systems - we leverage MRKL architecture 6 to support our dialogue system, which permits extensibility to multiple domains and incorporation of real-time data (e.g. stock prices, news, etc.)

- Language model fine-tuning - we are building LLMs that are fine-tuned to leverage CFP-like expertise across personal finance domains, including investing, retirement planning, taxes, insurance, borrowing, etc.

- Natural language processing - we are building systems that can interact with our users in all the familiar ways they prefer to interact, leveraging the latest in text-to-SQL, natural language code generation, and LLM prompting.

Our Team

Dennis